SR-22 Insurance Quotes

Get an SR-22 insurance quote online in minutes.

SR-22 Insurance Quotes

Get an SR-22 insurance quote online in minutes.

How it works

Step 1

Enter Zip Code

Step 2

SHOP AROUND Trying at Least 3 Quotes

Step 3

Buy the Cheapest Quote!

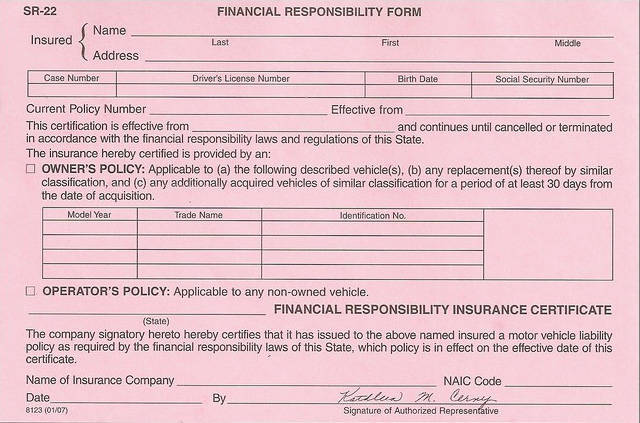

SR 22 Insurance OVERVIEW

It’s illegal to drive without car insurance in Oregon. The state requires drivers to carry several types of auto insurance coverage, including Liability Coverage, Personal Injury Protection (PIP), and Uninsured/Underinsured Motorist Protection. As a driver, you must provide proof of insurance to register your vehicle in Oregon. Driving without the required car insurance in the Beaver State attracts a serious punishment in the form of fines, confiscation of your car, and the suspension of your driving privileges by the Oregon Department of Motor Vehicles (OR DMV).

Make sure that you have met the state’s minimum auto insurance requirements whenever you are driving in Oregon. Even though the state requires drivers to have the necessary insurance to register their vehicles with the OR DMV, you can still be asked to present proof of insurance if you are pulled over by law enforcement officers. You can present either your insurance card or the declaration page of your auto insurance policy. Driving without insurance, DUI/DWI, and other serious violations may lead to the suspension of your driver’s license.

Restoring Your Driving Privileges with SR22 Insurance Oregon

What is SR22 car insurance?

What Is the Purpose of SR22 Insurance?

How Does the SR22 Oregon Insurance Work?

SR-22 Insurance Quotes

Get an SR-22 insurance quote online in minutes.

Who Needs SR22 Insurance in Oregon?

- You are trying to have your driving privileges restored after the suspension of your driver’s license. The SR22 obligation comes to effect on the end date of your suspension

- You are the owner of a car that was uninsured at the time of an accident. The SR22 obligation begins on the date of the accident

- You have been arrested and convicted of driving uninsured. The SR22 requirement starts on the date of the conviction

- You are applying for a probationary or hardship permit. The SR22 requirement starts on the date of application and ends on the date of expiration of the hardship permit

- If you have Type Action 04 involving uninsured drivers who did not pay the requisite compensation after causing injuries or property damage in an accident in the past.

How Do I Obtain an SR22 Insurance in Oregon?

What If I Am from Another State?

How Much Does an SR22 Certificate Cost in Oregon?

What If I Don’t Have A Car? (Non-Owner SR22 Insurance Oregon)

You still need to file an SR22 to legally drive in Oregon even if you don’t have a car registered under your name. If you have a non-owner car insurance policy, you can use it to fulfill this obligation. This policy is similar to a standard auto insurance policy in that it provides property damage and bodily injury coverage for the policyholder. Your SR22 filing will be attached to your non-owner’s auto insurance policy. By adding an SR22 endorsement to a non-owner’s policy, your insurance provider can help you fulfill SR22 requirements and have your license reinstated even if you don’t have a car registered under your name in Oregon.

In other words, a Non Owner SR22 Insurance Oregon is liability only insurance for drivers that does not own a vehicle. This type of liability covers any non-owned vehicle the policyholder borrows to drive occasionally. It serves as secondary insurance if the policyholder gets involved in an accident. In an accident, the primary insurance of the registered car owner will pay the damage claims first, and the Oregon SR22 Non Owner insurance will cover the excess amount in claims relating to the accident.

SR-22 Insurance Quotes

Get an SR-22 insurance quote online in minutes.

How Long Will I Keep the Oregon SR22 Insurance?

How Will an SR22 Requirement Affect My Auto Insurance Rates?

What Happens If I Don’t File an SR22 Form?

- Revoking or further suspensions of your Oregon driving privileges

- Arrest in the event of another violation or incident after your driving privileges have been suspended

- You may have to pay substantial fines

- The Oregon DMV may repossess your vehicle.

What Our Clients Say